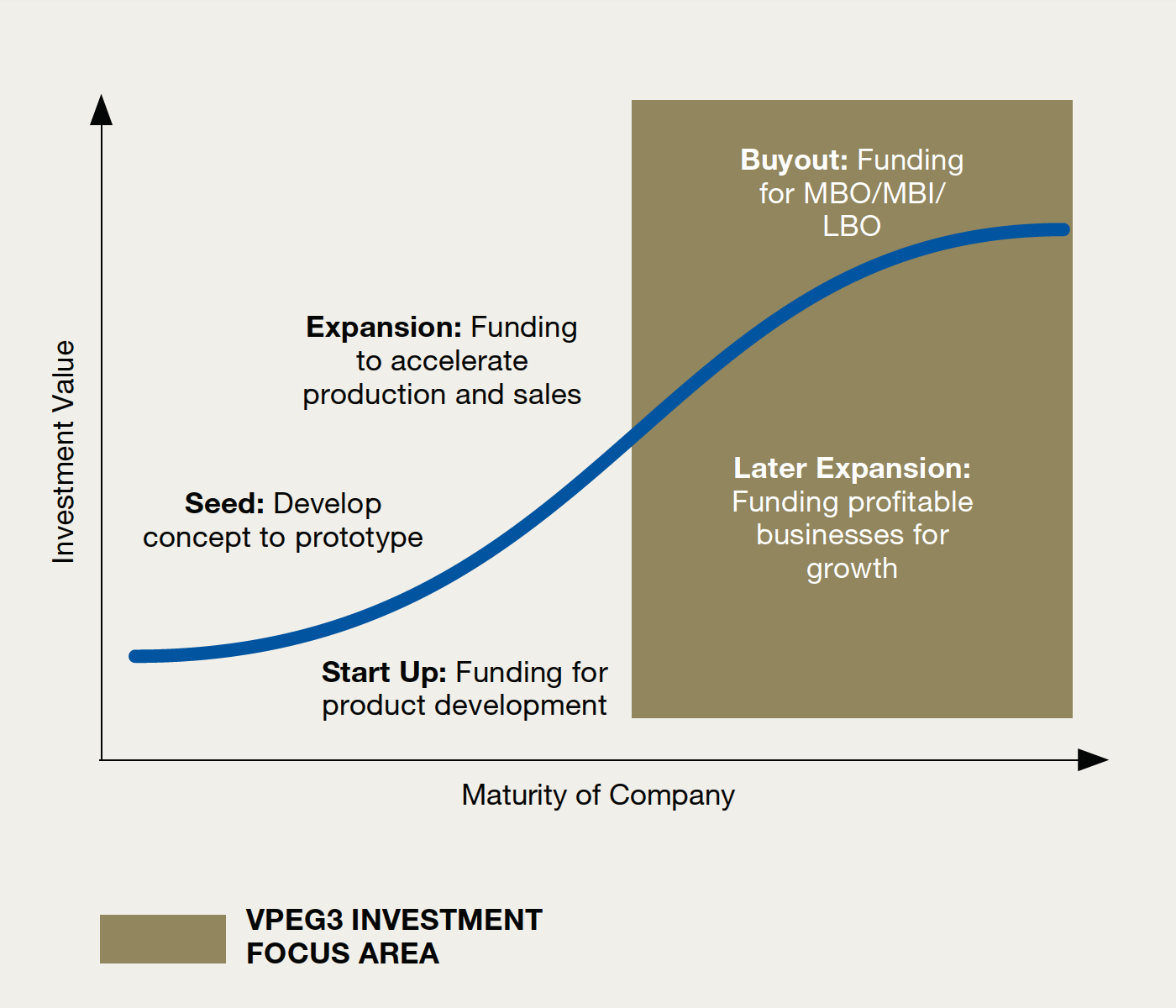

VPEG3 is focussed on providing all of its commitments and direct investments to underlying funds that in turn invest in profitable businesses, with proven products and services, that are at a more mature stage of development, and in particular the Later Expansion and Buyout stages of Private Equity investment.

Furthermore VPEG3 will only invest in funds targeting small to mid market sized investments with an enterprise value of generally between $25m to $250m at investment. It is this segment of private equity investing that has consistently delivered strong returns to investors globally over the past three decades.

In more detail, VPEG3’s investment strategy will evolve as follows:

Primary Private Equity Fund Investments

Following the First Closing Date, VPEG3 will make capital commitments to new (Primary) underlying private equity funds, managed by private equity firms that satisfy Vantage’s investment manager selection criteria and in accordance with VPEG3′s investment guidelines.

VPEG3 will target to commit to a minimum of four, and maximum of six, Primary Private Equity Fund Investments within 24 months of the Final Closing Date.

Secondary Private Equity Fund Investments

In addition, to further broaden the Vintage Year diversification of its Investment Portfolio, VPEG3 may also invest into existing or Secondary Private Equity Fund Investments, managed by private equity firms that satisfy Vantage’s investment manager selection criteria and in accordance with VPEG3′s investment guidelines.

Co-Investments

VPEG3 may also take advantage of opportunities granted by an underlying Private Equity Manager to make Co-Investments alongside a Primary or Secondary Private Equity Fund Investments. Up to 40% of VPEG3′s Private Equity Allocation may be allocated for Co-Investments, with no more that 10% of VPEG3′s Private Equity Allocation allocated to any one underlying company investment.

A Highly Diversified Private Equity Portfolio

Diversification of the VPEG3’s Private Equity Investment Portfolio will be achieved by spreading VPEG3’s Commitments and investments to Private Equity across the following five parameters; fund manager, financing stage, industry sector, geographic region and, vintage year.

When all of the VPEG3’s Private Equity Allocation is fully committed, the maximum percentage allocated to any one Private Equity fund is expected to be no more than 30% of the Aggregate Committed Capital of the Fund.

When VPEG3′s Private Equity Allocation is fully invested, a portfolio of up to 50 underlying private company investments could result.

Capital Calls for VPEG3 Investments

Over time and during the term of VPEG3, Capital Calls will be made by Vantage to each Investor in VPEG3 (with more than 8 Business Days notice allowed for payment) with the Called Funds applied towards meeting the call payment obligations for each Underlying Private Equity Investment undertaken by VPEG3, or to meet working capital requirements of the Trust.

Liquid Investments

Following the First Closing Date, any excess capital that has been called by VPEG3, that is not immediately invested in an Underlying Private Equity Investment will be invested into cash & short term deposit investments with one or more of the Big Four Banks (Liquid Investments).

VPEG3’s objective in making these initial Liquid Investments is to obtain income and capital stability without sacrificing liquidity. Over time and during the term of the Fund, amounts will be drawn from the Liquid Investments component of the Investment Portfolio and applied towards meeting call payment obligations for each Underlying Private Equity Investment as they occur, or to meet working capital requirements of VPEG3.

Distributions

The net proceeds of VPEG3′s investments in each underlying Private Equity Fund Investment, including proceeds from the realisation or sale of an investment and any dividends or interest received from an investment will be distributed to investors on a pro rata basis within 30 days of receipt.